Want to receive

business automation

insights straight

to your inbox?

AI

Sign Up to Our Newsletter

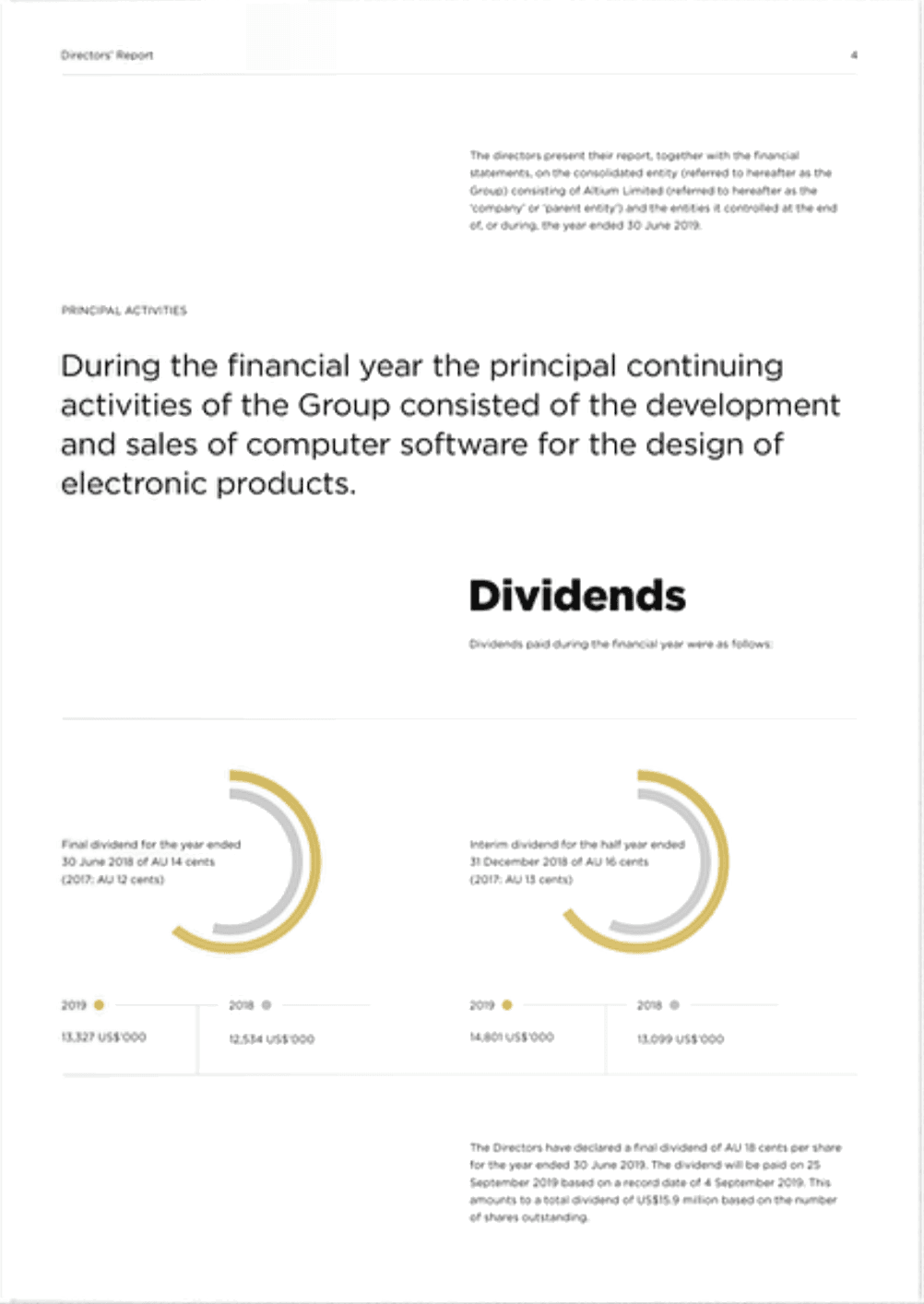

Looking to sell your company? Follow this 4-step process to boost your valuation.

Looking to sell your

company? Follow this

4-step process to

boost your valuation.

Informative

Informative

There is a key criteria investors consider when looking to acquire:

“Will the business continue to run itself after the founder leaves?”

Investors are very alert towards this issue because businesses that are over-reliant on the founder’s singular capability, or dependent on manual labor risk falling apart after acquisition.

Proofing your company against this very issue, will derisk your buyer and ultimately lead you to receive a higher valuation: a win-win deal.

Here are 4 practical steps you can take to ensure higher valuation for you and peace of mind for your buyer:

1. Identify areas of rudimentary, repetitive tasks.

This may be areas where you or your employees have been filling in with time-burning, manual labor such as:

• Filling data sheets/CRMs

• Identifying data patterns

• Responding to basic customer inquiries and reoccurring tickets

• Creating product catalogs

• Finding leads

• Other tasks that are unique to the nature of your business

2. Automate. Build a system of software that reduce your time spent on these tasks by 90%. Write down list of requirements and vet the solutions that work best for your business. Here are some examples:

• Zapier: Automate workflows between different web apps.

• Sendbird: Build your own customer chatbot

• Hypatos: Extract data from PDFs

• ActiveCampaign: Automate email sending based on conditional logic

• Thirdi: Have a team of AI experts build custom AI automations unique to your business

3. Continue to collect cost, revenue, and profit data for the next 3 ~ 6 months. With optimized workflows & offset labor costs you should be able to show a pattern of lower costs, higher profit margins and potentially higher revenue from newfound efficiency.

4. List your company at a higher multiple. Companies that have tech enabled operations/business models are perceived as having a better moat and higher value. This premium is amplified when the software is unique to your business (not available to your competitors) and powered by custom AI solutions.

Don't settle for a mediocre valuation when you’ve put in your blood, sweat and tears growing your business.

By following these four business-transforming steps, you'll not only be doing your investors a huge favor, but you’ll be giving your employees meaningful work instead of drudging tasks, and will be securing a lucrative exit that rewards you for your hard work and innovation.

#Valuation #Acquisition #Investor #Automation #AI #BusinessOwner #Founder #Startup #Exit

There is a key criteria investors consider when looking to acquire:

“Will the business continue to run itself after the founder leaves?”

Investors are very alert towards this issue because businesses that are over-reliant on the founder’s singular capability, or dependent on manual labor risk falling apart after acquisition.

Proofing your company against this very issue, will derisk your buyer and ultimately lead you to receive a higher valuation: a win-win deal.

Here are 4 practical steps you can take to ensure higher valuation for you and peace of mind for your buyer:

1. Identify areas of rudimentary, repetitive tasks.

This may be areas where you or your employees have been filling in with time-burning, manual labor such as:

• Filling data sheets/CRMs

• Identifying data patterns

• Responding to basic customer inquiries and reoccurring tickets

• Creating product catalogs

• Finding leads

• Other tasks that are unique to the nature of your business

2. Automate. Build a system of software that reduce your time spent on these tasks by 90%. Write down list of requirements and vet the solutions that work best for your business. Here are some examples:

• Zapier: Automate workflows between different web apps.

• Sendbird: Build your own customer chatbot

• Hypatos: Extract data from PDFs

• ActiveCampaign: Automate email sending based on conditional logic

• Thirdi: Have a team of AI experts build custom AI automations unique to your business

3. Continue to collect cost, revenue, and profit data for the next 3 ~ 6 months. With optimized workflows & offset labor costs you should be able to show a pattern of lower costs, higher profit margins and potentially higher revenue from newfound efficiency.

4. List your company at a higher multiple. Companies that have tech enabled operations/business models are perceived as having a better moat and higher value. This premium is amplified when the software is unique to your business (not available to your competitors) and powered by custom AI solutions.

Don't settle for a mediocre valuation when you’ve put in your blood, sweat and tears growing your business.

By following these four business-transforming steps, you'll not only be doing your investors a huge favor, but you’ll be giving your employees meaningful work instead of drudging tasks, and will be securing a lucrative exit that rewards you for your hard work and innovation.

#Valuation #Acquisition #Investor #Automation #AI #BusinessOwner #Founder #Startup #Exit

Want to receive business automation insights straight to your inbox?

Want to receive business

automation insights straight

to your inbox?

Sign Up to Our Newsletter

AI

Sign up for AI insights

Let’s Chat

Want to see which AI solutions are fit for

your business?

For more insights to supercharge your

business,

Take our Automation Potential Quiz 📋

Sign Up to Our Newsletter 💌

Still Have Questions?

Last Call !!

Boost Efficiency & Scale

Your Business with Thirdi’s

Custom Built AI Solutions

Automate repetitive workflows, optimize admin & marketing,

and stay ahead of your competition.

You’re in the Right Place.

We’re here to give you a Competitive Advantage

⚡️Supercharge⚡ Every Aspect

of Your Business through

Function Specific Solutions

Repetitive, Manual work is

Weighing Your Business

Down 📉

Other agencies provide surface level solutions through APIs. We build something just for you using our extensive tech stack.

Automate your marketing, operations, customer service

and many more. Mix and match different services to

boost synergy.

Your competitors are boosting their efficiency by at least 30% simply by automating your repetitive tasks.

Custom Built = Competitive Advantage

Our Services

Your Business

Thirdi Enabled Competitors

AI

“I couldn’t believe it - sales shot ..up by 37.5%.”

Taylor Sjørk, Founder of Blend

⭐️⭐️⭐️⭐️⭐️

“After I started using an automated marketing funnel for my online store, I couldn't believe it - sales shot up by 35.7%! It's amazing how much of a difference the right digital approach can make.”

“We’ve unlocked a secret weapon ..in our marketing arsenal.”

John Van Dam, Founder of OGC Horizontal

⭐️⭐️⭐️⭐️⭐️

"I've tried the usual route with traditional digital marketing agencies, and it's been okay. But ever since I switched to AI-powered strategies, the difference is night and day. It's not just the lack of typical agency headaches; the results we're seeing are on a whole new level. It's like we've unlocked a secret weapon in our marketing arsenal."

Simmons Doherty, CTO of Tracksoft

“They truly understand how to make ..your vision a reality.”

⭐️⭐️⭐️⭐️⭐️

"I had this cool idea I wanted to prototype using AI automation, and the team at Thirdi was incredible. They were insightful and delivered an unreal solution in such a short time. If you're looking to bring an idea to life with AI, I highly recommend trying out Thir-di's AI automation services. They truly understand how to make your vision a reality.”

“I was able to finally scale my ..client list”

Daniel Hwang, Independent Realtor

⭐️⭐️⭐️⭐️⭐️

“Thirdi brought in qualified leads for my practice, I was having extreme difficulty finding the perfect client for my services. With Thirdi’s automated vetting solution I was able to finally scale my client list.”

⭐️⭐️⭐️⭐️⭐️

When I first heard that I could automate a lot of my admin work without hiring a whole team, I was skeptical. But they really did it. It's a game changer; I'm no longer drained by time-consuming tasks I'm tired of. This shift allows me to be more customer-facing and invest my energy where it's most needed.

Trevor Lemore, Founder of Auto Ninjas

“I'm no longer drained by time ..consuming tasks I'm tired of.”

“I couldn’t believe it - sales shot ..up by 37.5%.”

Taylor Sjørk, Founder of Blend

⭐️⭐️⭐️⭐️⭐️

“After I started using an automated marketing funnel for my online store, I couldn't believe it - sales shot up by 35.7%! It's amazing how much of a difference the right digital approach can make.”

“We’ve unlocked a secret weapon ..in our marketing arsenal.”

John Van Dam, Founder of OGC Horizontal

⭐️⭐️⭐️⭐️⭐️

"I've tried the usual route with traditional digital marketing agencies, and it's been okay. But ever since I switched to AI-powered strategies, the difference is night and day. It's not just the lack of typical agency headaches; the results we're seeing are on a whole new level. It's like we've unlocked a secret weapon in our marketing arsenal."

Simmons Doherty, CTO of Tracksoft

“They truly understand how to make ..your vision a reality.”

⭐️⭐️⭐️⭐️⭐️

"I had this cool idea I wanted to prototype using AI automation, and the team at Thirdi was incredible. They were insightful and delivered an unreal solution in such a short time. If you're looking to bring an idea to life with AI, I highly recommend trying out Thir-di's AI automation services. They truly understand how to make your vision a reality.”

“I was able to finally scale my ..client list”

Daniel Hwang, Independent Realtor

⭐️⭐️⭐️⭐️⭐️

“Thirdi brought in qualified leads for my practice, I was having extreme difficulty finding the perfect client for my services. With Thirdi’s automated vetting solution I was able to finally scale my client list.”

⭐️⭐️⭐️⭐️⭐️

When I first heard that I could automate a lot of my admin work without hiring a whole team, I was skeptical. But they really did it. It's a game changer; I'm no longer drained by time-consuming tasks I'm tired of. This shift allows me to be more customer-facing and invest my energy where it's most needed.

Trevor Lemore, Founder of Auto Ninjas

“I'm no longer drained by time ..consuming tasks I'm tired of.”

You’re in Good Great

Hands 🙌

There’s a reason 98% of our partners are satisfied. Our

commitment doesn't end until we're certain our solutions have propelled you forward.

Trevor Lemore, Founder of All Things Automotive

98% Customer Satisfaction Rate

First Come First Serve ⬇️

Our Timeline

We’re ready to work with you and build a

solution just for you.

Our Proposal

We will prepare and send you a proposal of a solution tailor-fit to your business needs/challenges.

Initial Meeting

Understanding your challenge & aligning expectations.

Check-in

Meeting to update our progress, and hear your feedback.

Implementation (Delivery)

Share complete Thirdi solution, integrated seamlessly into your workflow/ software suites. Help you onboard.

Maintenance

Ensure quality and help troubleshoot issues until you are fully satisfied. Provide updates based on your evolving needs.

Book a Call

Use Cases

Use AI to help collect data for research & strategize your business

Efficiently personalize pitch decks to potential investors with only the most relevant content using LLM.

Integrate to your CRM and inform your outreach timing and decisions based on customer behavior.

Help collect funneled data from external platforms like LinkedIn, or your website to help aid decisions.

Market Research

Marketing Automation

Sales Automation

Data Scraping

Good to Go from Day One

We make sure our solutions are fully integrated into

your existing tools.

Integrations ✅

Other Agencies

Surface level solutions connected to APIs like ChatGPT.

Cookie cutter AI solutions (APIs) from a third party provider

sold to you at a premium.

Slightly modified, but not custom fit for your specific and

niche business needs.

Other Agencies

+ $$

Custom developed case-specific, AI integrations built into your existing software suite.

Fit to your business needs and easily adjustable to changing circumstances.

Thirdi.co

C++

Mongo DB

Python

Powerful applications built from scratch with our tech

stack.

Working with us is how you get leverage over your competition.

Sales

Automation

Customer

Service

Admin

Automation

Market

Research

Marketing

Automation

Prototyping

Lead Gen/Vetting

Data Scraping

Cold Calling System

Custom

prototypes to bring

your ideas to market.

SMS Interactions

Social Media

SEO

Prospecting

Customer Support

Chat Bots

Workflows

HR (Onboarding,

Contracts)

CRM Integration

Quality Assurance

Live Price Tracking

Event Alerts

Trend Research

AI

Thirdi

“When I first heard that I could automate my admin work without

hiring a whole team, I was skeptical.

But they really did it. It’s a game changer - now, I can focus on what

truly matters in my business:

helping my customers.”

Get in Touch

👋

⚠️ Here’s the Problem ⚠️

Sign up for AI insights

I agree with the terms & conditions.

Thirdi.co

See how much potential you’re missing out on 🚨

( And many more )

Tailored to Your Business

Needs.

How We’re Different

We don’t use cookie-cutter AI solutions from a third party. We build everything from scratch from our

AI/ML technologies.

Ready to Supercharge Your

Business? Book a Call.

Sign up for AI insights

Sign up for AI insights